when will capital gains tax increase in 2021

Its time to increase taxes on capital gains. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

1 week ago Jan 07 2021 In all Canadians realized 729 billion in taxable capital gains.

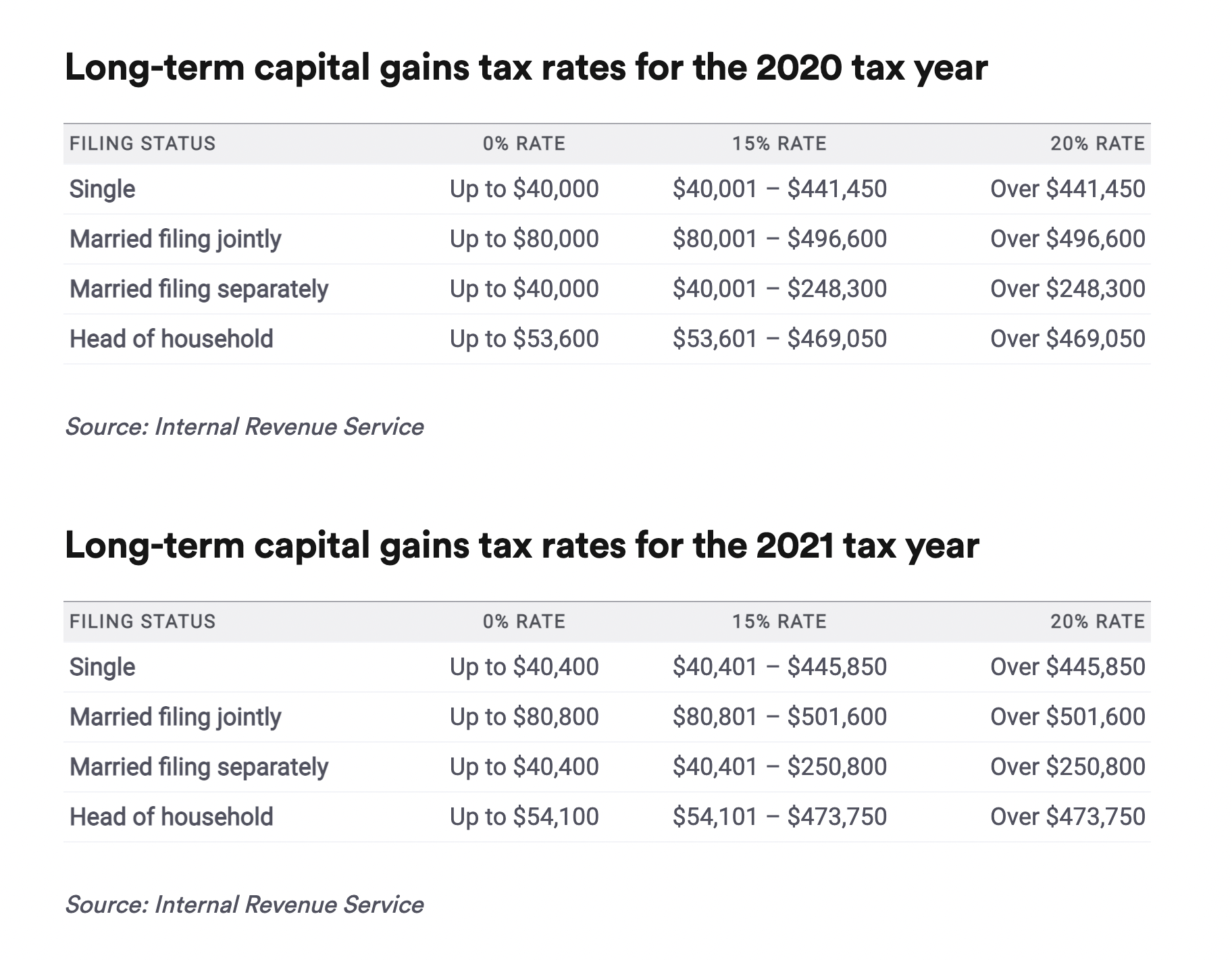

. Understanding Capital Gains and the Biden Tax Plan. In 2021 and 2022 the capital gains. Long-Term Capital Gains Taxes.

And is based on the tax brackets of 2021 and 2022. As proposed the rate hike is already in effect for sales after April 28 2021. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

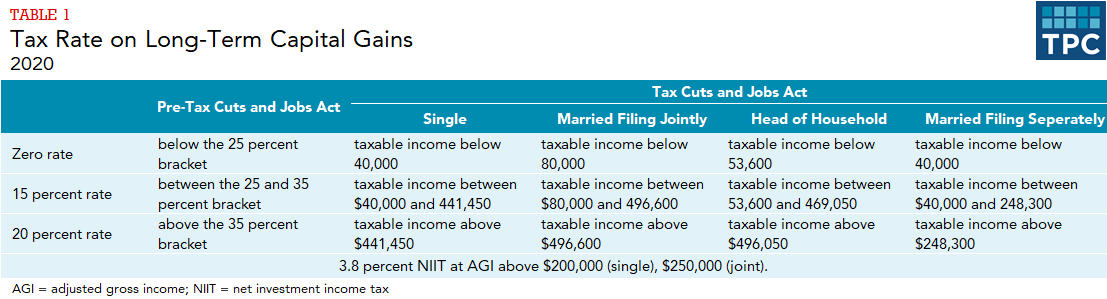

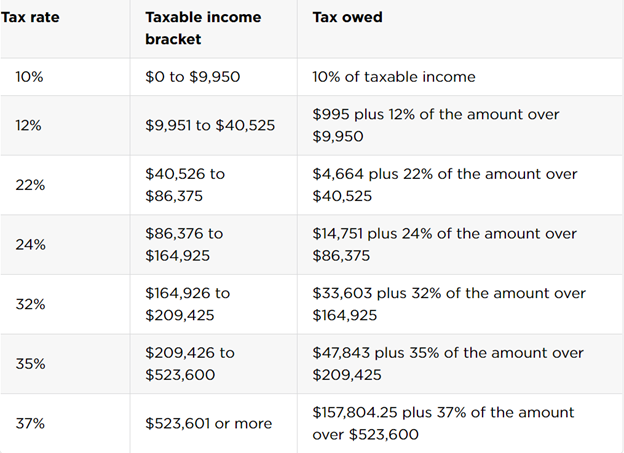

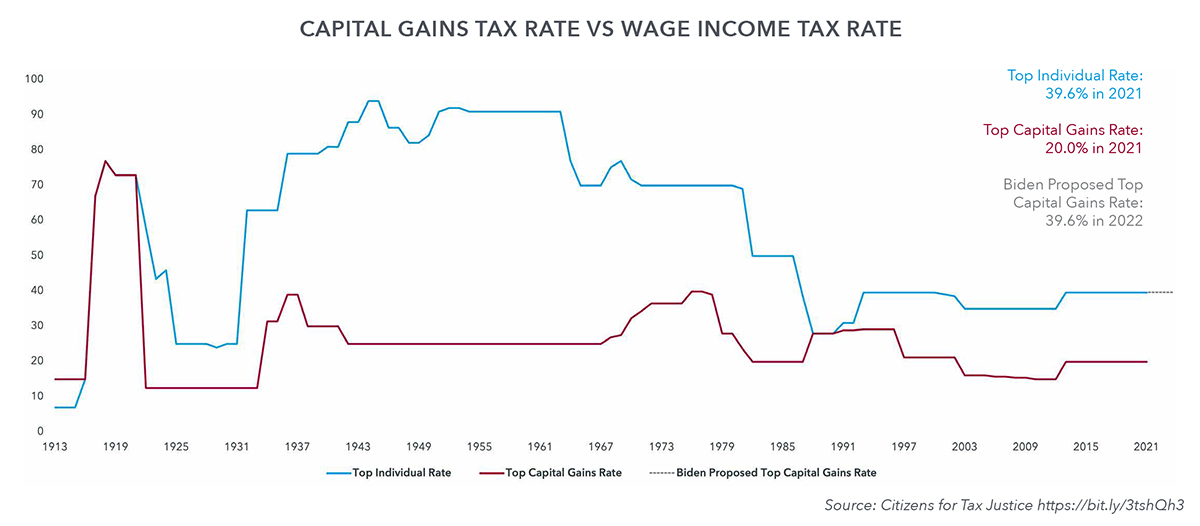

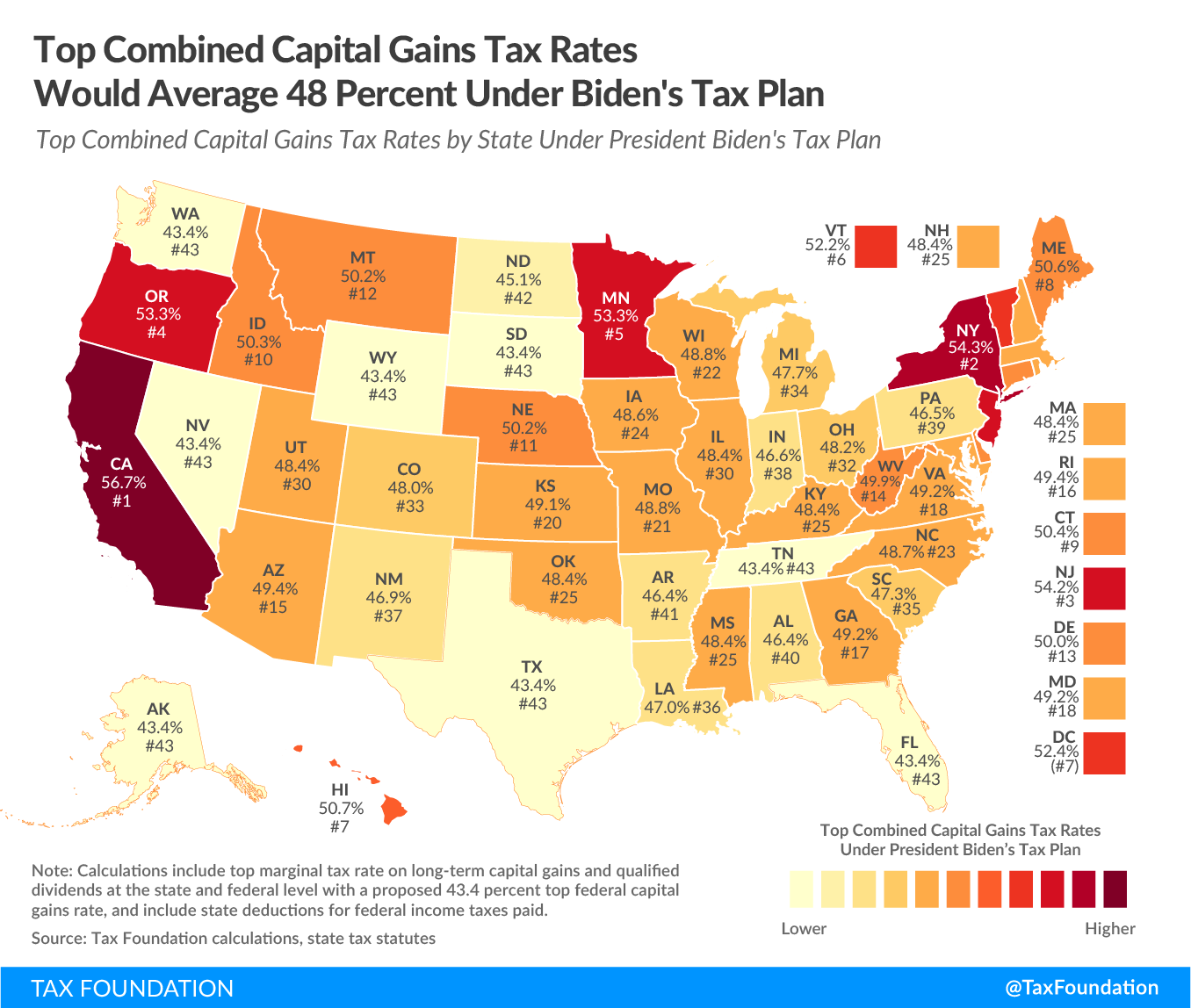

The 238 rate may go to 434 an 82 increase. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate.

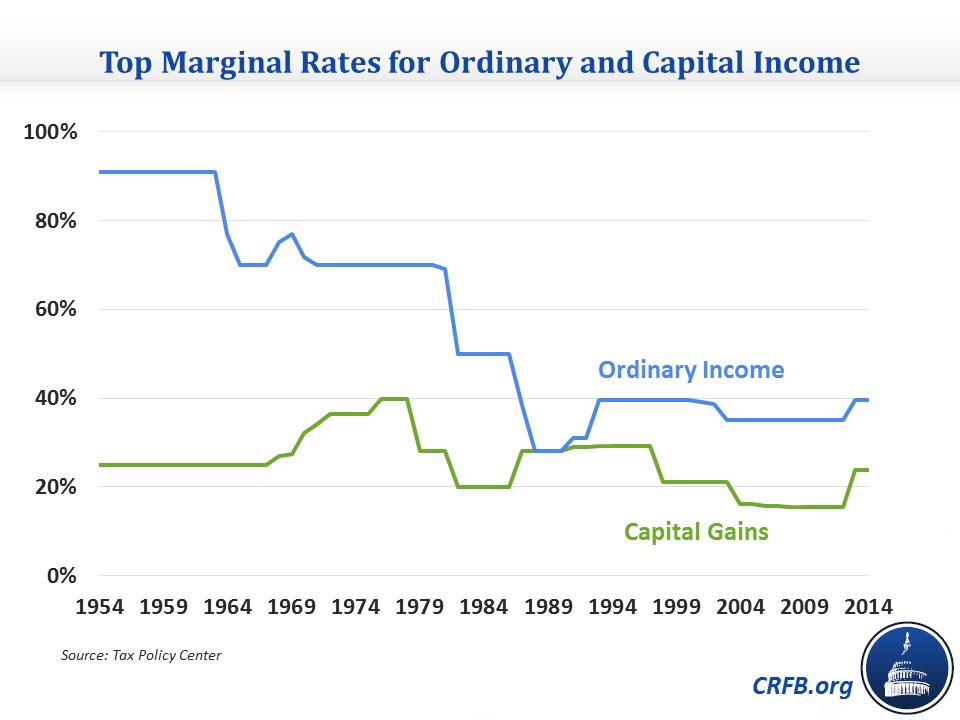

The lifetime capital gains exemption is 892218 in. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. 2022 capital gains tax rates.

Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest Americans. In 2021 and 2022 the capital gains tax rate is 0.

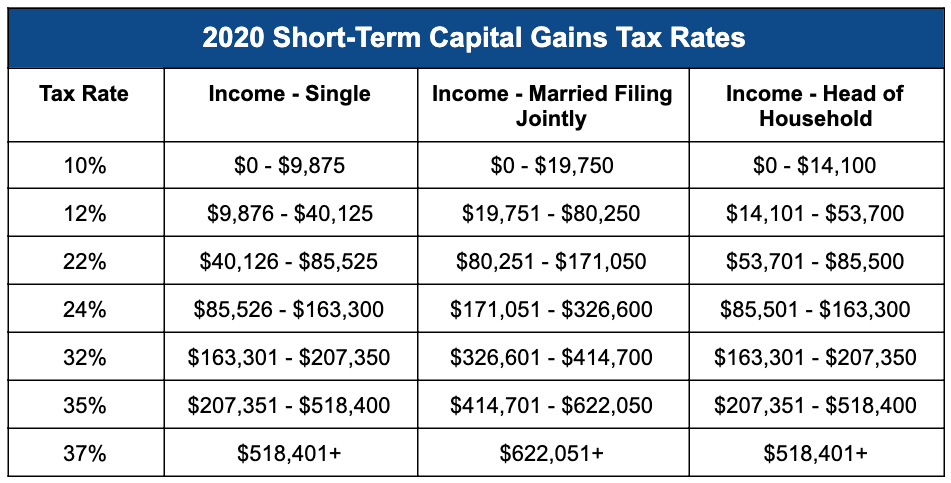

Note that short-term capital gains taxes are even higher. The effective date for this increase would be September 13 2021. This means that high-income investors could have a tax rate of up to.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Of the total 546 percent was. The changes will be effective from the new tax year starting 6 April 2021.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Capital gains tax is likely to rise to near 28 rather than 396. Add state taxes and you may be well over 50.

It is mainly intended for residents of the US. Specifically the current top. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci.

To address wealth inequality and to improve functioning of our tax. Could capital gains taxes increase in 2021. Apr 23 2021 305 AM.

If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies. Posted on January 7 2021 by Michael Smart.

When the Treasury introduced changes to the Entrepreneurs Relief now Business Asset Disposal. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate. However it was struck down in March 2022.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Capital gains tax rates on most assets held for a year or less correspond to. Its time to increase taxes on capital gains - Finances of.

The 2022 tax values can be used for 1040-ES estimation. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

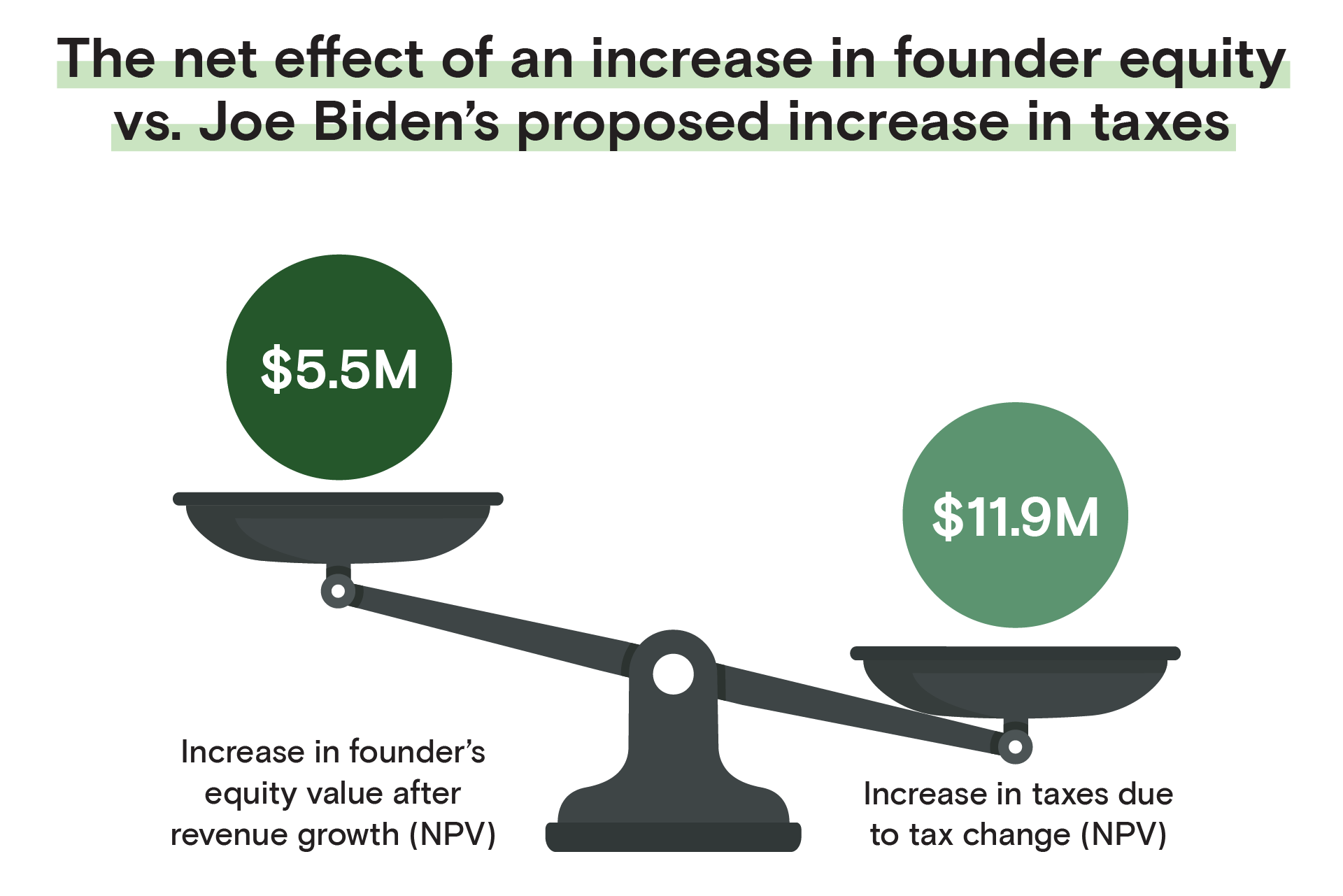

For Founders The Implications Of Joe Biden S Proposed Tax Code

Crypto Tax 2021 A Complete Us Guide Coindesk

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Effects Of Changing Tax Policy On Commercial Real Estate

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Capital Gains Tax In The United States Wikipedia

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

Income Tax And Capital Gains Rates 2021 03 01 21 Skloff Financial Group

Managing Tax Rate Uncertainty Russell Investments

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Short Term And Long Term Capital Gains Tax Rates By Income